A Sustainable Plan for the Budget ‘Surplus’ in West Virginia

From the Weekly Post of the WV Center on Budget & Policy, February 17, 2023

The 2023 state legislative session has seen both chambers heavily focused on turning the state’s revenue “surplus” into personal income tax cuts, despite the clear need for new spending after four years of austerity forced by flat budgets. We’ve covered at length the temporary factors driving the surplus, as well as the fallacy of calling it a surplus at all when much of that money is obligated to future budget spending based on decisions lawmakers have already made. This piece will take a look at West Virginia’s expected FY 2023 surplus and outline how we could spend it in equitable and sustainable ways while still meeting our budget obligations.

Seven months into the fiscal year, West Virginia has a budget surplus of $995.3 million. Half of that, $497.8 million, is severance tax collections above estimates, which have resulted from temporarily high energy prices due to factors outside of West Virginia’s control. To put the historic severance tax collections into context, just seven months into FY 2023, we’ve collected 252 percent of the severance tax we estimated to bring in this year.

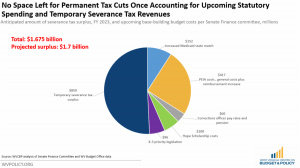

If current revenue trends continue, we would expect the total FY 2023 surplus to be just over $1.7 billion, which is the amount state officials are projecting as well.

Earlier this month, Senate Finance Chairman Eric Tarr identified in an interview that they used the budget hearing process as a workaround to understand each state agency’s upcoming spending needs. What the Senate Finance committee learned is that the state is already on the hook for “at least $917 million” in ongoing, base budget spending obligations based on legislation previously passed, which means that much of the surplus is simply not available to fund tax cuts without changing existing laws or drastically cutting the budget. Chairman Tarr noted that over $900 million is already obligated before lawmakers pass any additional legislation this year that has a price tag.

That leaves about $800-850 million remaining of the FY 2023 surplus. If current trends continue, we can expect the severance tax portion of the surplus to be around $800-850 million. We’ve long cautioned that severance tax revenues are incredibly temporary as they are tied to volatile energy prices. A fiscally responsible practice would be to not use any temporary severance tax revenue toward permanent spending — either for the budget or for permanent tax cuts. That said, it’s important for the state to meet its legal spending obligations.

With the $800-850 million of severance tax surplus remaining, these funds could be incredibly transformative in the coal and natural gas communities where these tax benefits derive from and which, in many cases, have seen underinvestment in recent years in both infrastructure and economic development. Last year, we called on lawmakers to create an infrastructure and development fund for counties that have coal and natural gas production and to place the FY 2023 severance tax surplus into that fund. With an $800-850 million pot of money, many meaningful projects could be pursued to improve economic opportunities in these communities for this and the next generation.

That more than exhausts the FY 2023 surplus. However, some of the costs Chairman Tarr identified as upcoming base-building costs do not become part of the budget until FY 2025 or later. Additionally, the state still has about $500 million in unappropriated surplus funds from FY 2022 that could go to one-time needs, but again, it would be deeply irresponsible to base any ongoing spending or tax cuts on temporary surplus dollars—either those from the severance tax or from the remaining FY 2022 surplus.

West Virginia could make some long-needed one-time investments with these dollars — for example, investing in child care subsidies for thousands of families who lost theirs at the end of last year, launching a paid family and medical leave program, and investing in education and workforce training programs.

There are also equitable one-time ways to get money back into the pockets of West Virginians. The best option would be a child tax credit applied to all children in the state under the age of 18. For about $350 million, every child in the state could get a one-time $1,000 child rebate. If revenues continue to grow in future years, the legislature could come back and consider making the program permanent.

West Virginia’s FY 2023 surplus does present significant opportunities to invest in our people—but most of that investment will need to be in the form of meeting our obligations for public services that serve all of our people. The plan laid out above to meet our spending obligations, invest temporary severance tax revenues back into our coal and natural gas communities, and get more money into the pockets of families with children is both a sustainable and an equitable approach.

Read Kelly Allen’s full blog post here.

https://wvpolicy.org/whats-a-sustainable-plan-for-west-virginias-surplus/